Every quarter brings a financial data storm for business owners and accountants.

It takes a lot of time and human effort to sift through the statements, invoices, and accounts and get the real insights. This process can be made smoother, faster, and easier, thanks to artificial intelligence. In this article, we offer multiple approaches to analyze your QuickBooks data with AI.

How you can analyze QuickBooks data with AI

Before diving into specific methods, it’s important to understand the AI landscape for QuickBooks data analysis. You have three main approaches to analyze QuickBooks data with AI:

- Coupler.io – it’s a data integration and automation platform that enables you to create data flows from QuickBooks and integrate them with AI tools like ChatGPT and Claude.

So, you do not integrate the entire QuickBooks account with AI, but choose which data sets to give access to. This requires only a few simple steps and no coding. Once connected, you can analyze QuickBooks data through natural language conversations. Just ask questions and get insights into your financial data in AI tools.

- Use Intuit Assist for QuickBooks – It’s the native generative AI feature offered within the platform to analyze your data. Though powerful, it’s not designed specifically for analytics, and only users in selected countries can access the assistant. It also means not accessible to every team member who doesn’t have direct access to the QuickBooks platform.

- Create an AI workflow using n8n – You can use workflow automation platforms like n8n for analyzing QuickBooks data with AI. Build a multi-step workflow that pulls data from QuickBooks and connects to AI models like GPT or Gemini for analysis tasks. The major disadvantage here is that it has a steeper learning curve and is more technical as compared to other options.

There are other ways too — like using Google Sheets AI functions or Excel integrations. The most basic way to use AI for QuickBooks data analysis is to upload it into an AI tool like ChatGPT or Claude.

But that’s not how you should do it.

The reason is that financial data is highly structured, requiring proper organization and querying for accurate analysis. Simply pasting the data into generative AI tools may take away its structure, leading to misinterpretations.

The number of possible options are overwhelming, therefore, in the following sections, we only cover the easiest, most streamlined, and efficient AI methods to analyze QuickBooks data.

QuickBooks native AI with Intuit Assist

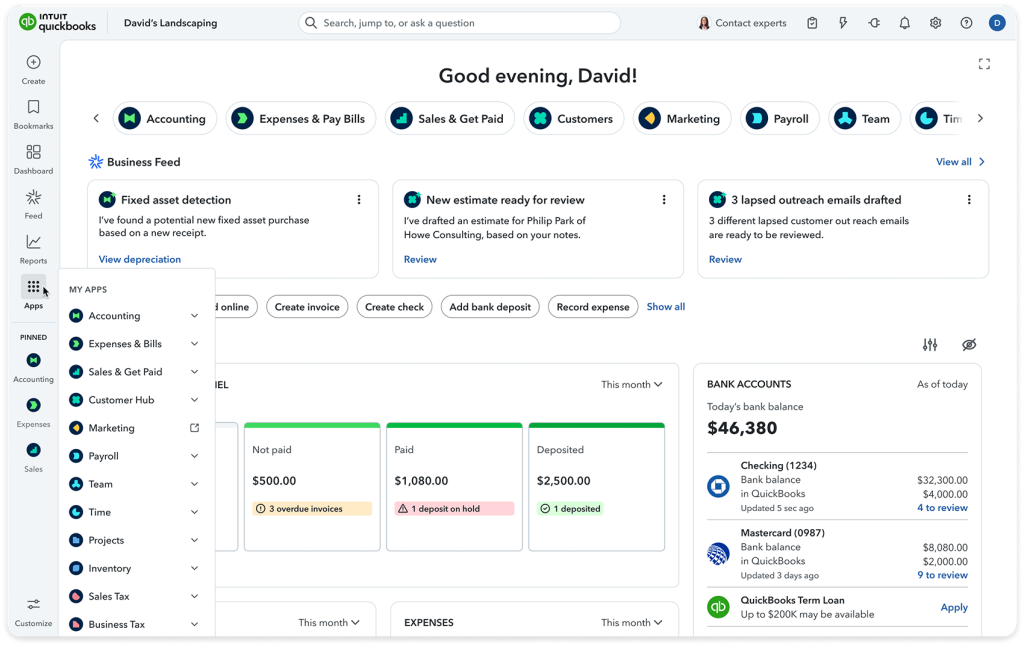

QuickBooks offers built-in AI capabilities through Intuit Assist, which includes several specialized AI agents designed to automate different aspects of financial management.

Finance agent: Provides automated financial reporting, KPI analysis, and scenario planning. It generates monthly summaries on the 5th of each month with insights into your business finances, key highlights, and detailed breakdowns of your financial data. You can learn more about the Finance Agent and how it benchmarks your performance against industry peers.

Accounting agent: Automates bookkeeping tasks including transaction categorization and reconciliation assistance, helping maintain cleaner and more accurate books.

Payments agent: Optimizes cash flow by automating invoice reminders and payment collection. Users typically get paid 5 days faster on average with AI-drafted invoice reminders.

Document processing: Create invoices and expense records directly from photos of notes, emails, and documents. The AI can convert client visit notes into estimates or invoices within minutes.

Benefits of QuickBooks native AI

- Zero setup required – Works immediately within your existing QuickBooks account

- Seamless integration – All insights and automations happen within the QuickBooks interface

- Automated workflows – Handles routine tasks like invoice reminders and transaction categorization

- Monthly financial summaries – Receive proactive insights about your business performance

- Industry benchmarking – Compare your financial performance against similar businesses

- Mobile accessibility – Access AI insights through QuickBooks mobile apps

Limitations of QuickBooks native AI

- Geographic restrictions: Intuit Assist and advanced AI features are only available in selected countries, including the United States,the United Kingdom, Australia, India, Singapore, and South Africa. Users in other regions have limited or no access to these AI capabilities. Check the complete list of supported countries before getting started.

- Data scope limitations: Analysis is restricted to QuickBooks data only. You cannot combine data from other business tools like marketing platforms, CRM systems, or external databases.

- Limited conversational analytics: While you can ask basic questions, the AI interaction is primarily through predefined reports and summaries rather than open-ended conversations.

- Subscription requirements: Many advanced AI features require specific QuickBooks Online subscription tiers and may not be available in all plans.

QuickBooks native AI is an excellent starting point for businesses that are satisfied with automated summaries and standardized reports.

As your business evolves, you might find yourself asking questions that go beyond QuickBooks data alone:

“How does our marketing spend correlate with revenue growth?” “Which customer segments from our CRM are most profitable according to our financial data?” “Can I analyze our project profitability alongside team productivity metrics?”

These questions require combining QuickBooks financial data with information from other business systems. You might also want more flexible conversations with AI—asking follow-up questions, exploring different scenarios, or getting insights tailored to your specific industry.

This is where Coupler.io becomes valuable.

Chat with your data using QuickBooks integration with AI by Coupler.io

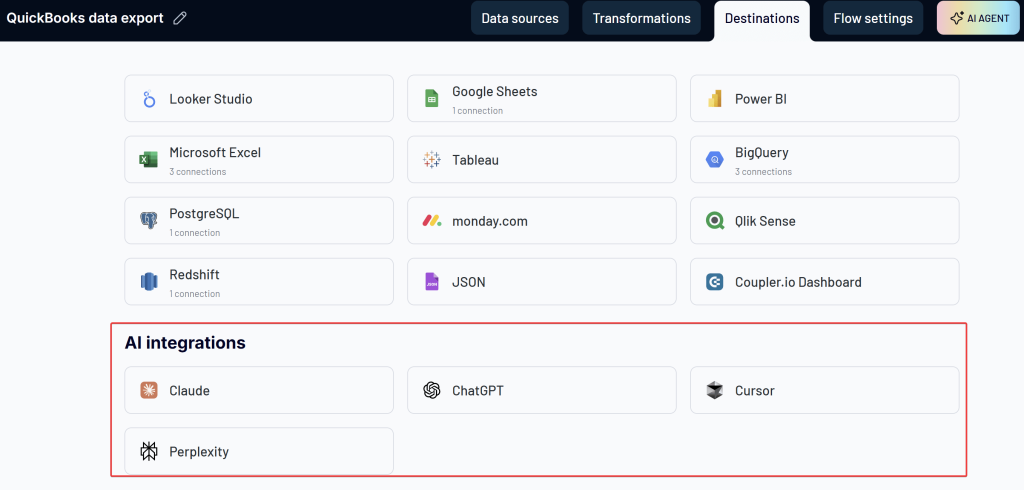

Coupler.io is a reporting automation platform for 300+ popular data sources, including QuickBooks. It creates an automated data flow to destinations like BI platforms, spreadsheets, data warehouses, and also AI tools like ChatGPT and Claude.

Let’s see an example of connecting QuickBooks to ChatGPT.

Note: The QuickBooks data set will only be accessible by the AI tool to which you’ve connected the data flow. If you’ve integrated the data with ChatGPT, other AI tools won’t have access to your QuickBooks data.

Step 1: Create a QuickBooks data flow in Coupler.io

To start, click Proceed in the below form. It will take you to a pre-configured dataflow to analyze QuickBooks data in ChatGPT. You can change destination to Claude if needed.

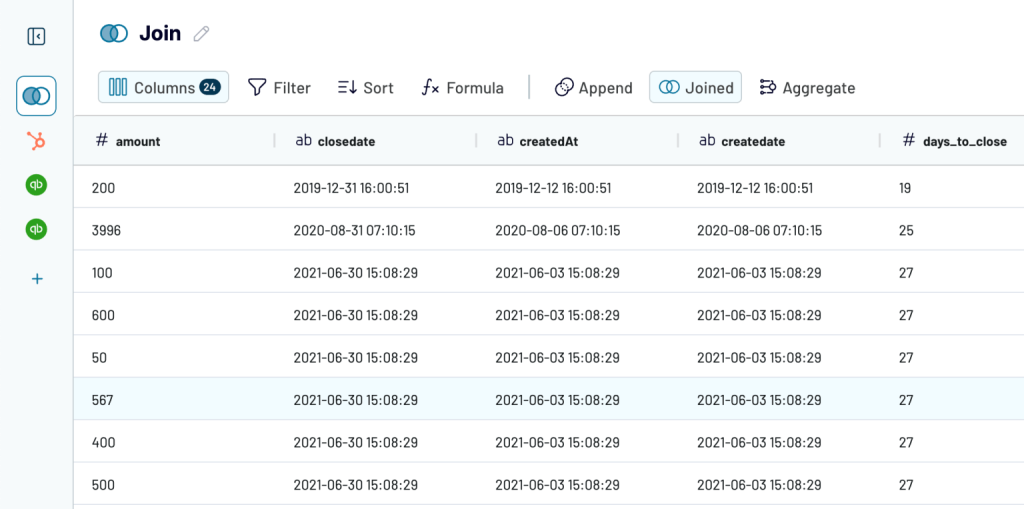

Create a Coupler.io account and connect your QuickBooks Online account. Then, select the data entity to fetch (for example, bills). You can also add additional related data sources that you want to analyze along with the QuickBooks data. Learn more about how to combine data from multiple sources with Coupler.io

Next, review the QuickBooks data and perform transformations, if needed. In this step, you can:

- Hide irrelevant columns

- Rename or rearrange the columns

- Filter the data based on conditions

- Sort the data by a specific column

- Aggregate metrics (SUM, COUNT, AVERAGE, MIN, or MAX)

There is also an option to combine data from multiple data sources. However, the value for this depends on what data set you’re going to analyze with AI.

For similar data types (like expenses from different departments), combining data makes sense since it creates a unified view.

For different data types (like bills and customer data), it’s often better to created separate data flows connected to AI to avoid confusion. Our AI integrations allows you to handle multiple data flows in one conversation to analyze them together or separately as needed.

Once the data looks good, proceed to the final step. Select the AI tool to integrate your data flow.

Then follow the in-app instructions to set up the integration and, IMPORTANTLY, save and run the data flow in the Coupler.io interface. After a successful run, you’ll be able to ask questions about your data using the chosen AI tool.

Step 2: Analyze QuickBooks data in AI tools

Let’s say you’ve integrated some data from QuickBooks with ChatGPT. The ChatGPT integration is implemented via a custom Coupler.io GPT, to which you’ll need to log in from Coupler.io. Here, you can give instructions to analyze QuickBooks data with AI.

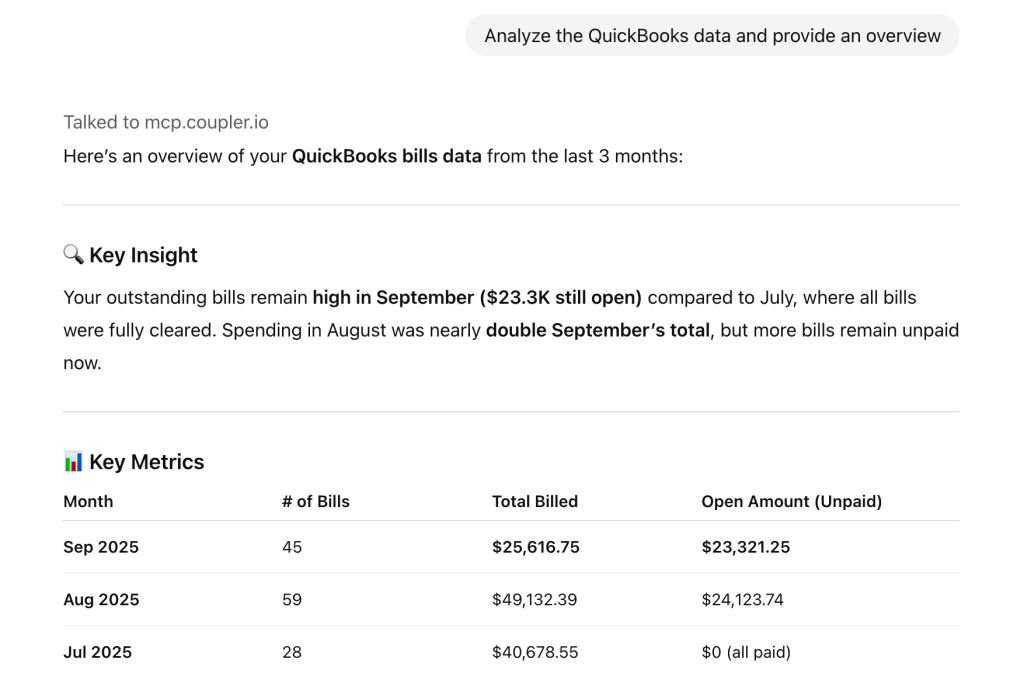

For example, here’s an overview of my QuickBooks bills data ChatGPT analyzed for me:

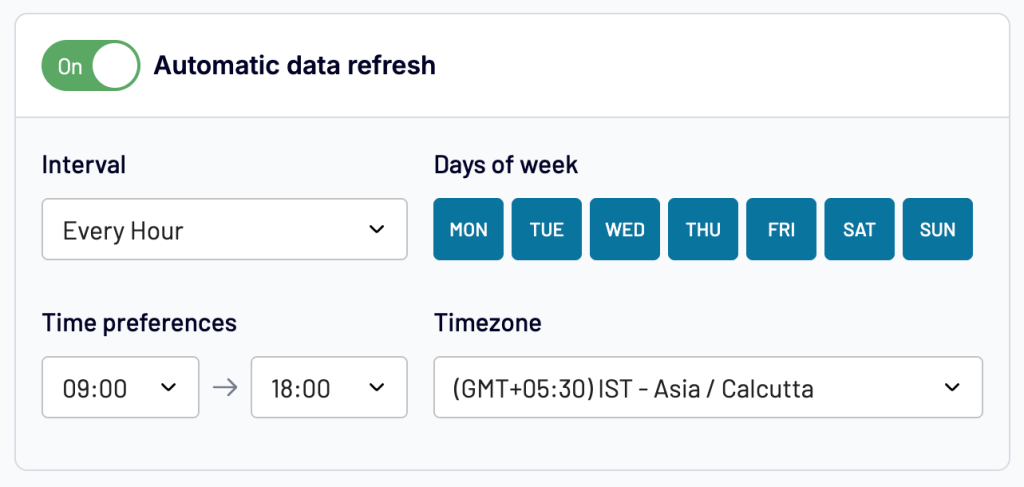

To always ensure access to your latest data from QuickBooks, turn on the automatic data refreshes in Coupler.io. You can set the refresh interval as fast as every 15 minutes for almost real-time data analysis.

Once the auto-refresh is set up, you can use the Coupler.io GPT anytime to ask questions about your latest QuickBooks data. You don’t need to repeat any of the previous steps any more; the Coupler.io will automatically pull the data and feed it to ChatGPT.

In the same way, you can connect your QuickBooks data with Claude for analysis using the AI integrations offered by Coupler.io.

Integrate your financial data with AI for conversational analytics

Try Coupler.io for freeExamples of questions to ask AI about your QuickBooks data

Once you’ve connected your data to AI, you can benefit from conversational analytics by chatting with ChatGPT

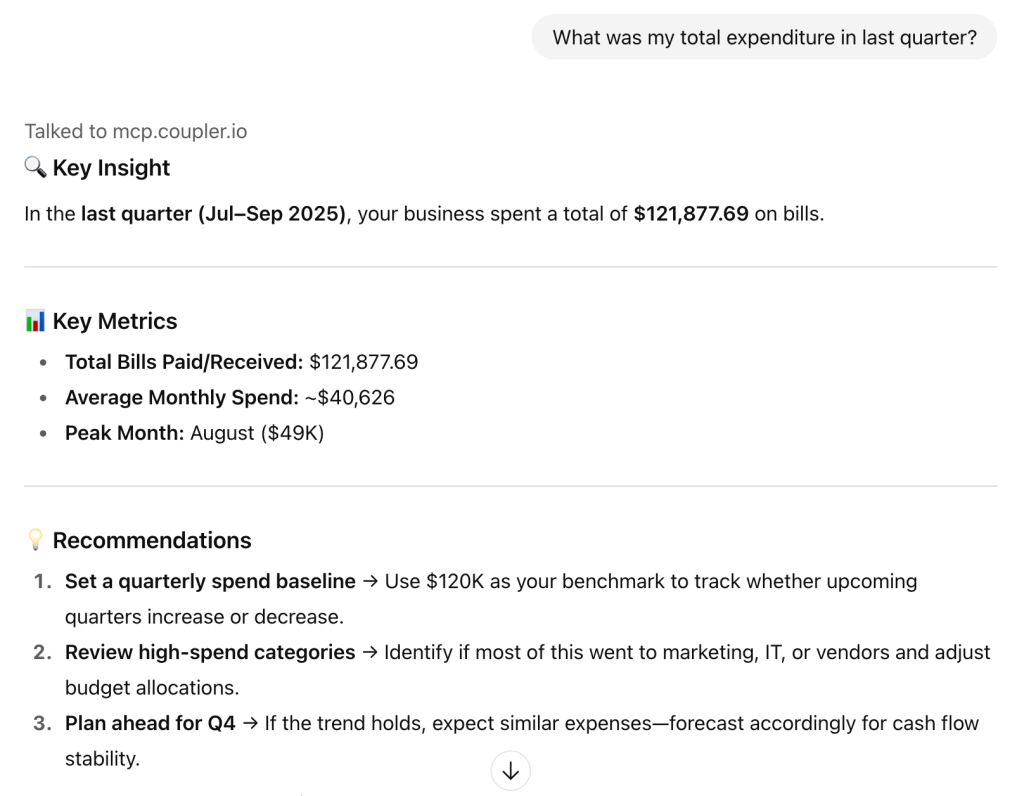

For example, you can ask direct questions to get summaries and metrics like “What was my total expenditure in last quarter?” for efficient financial reporting.

You see, AI not only offers the required data, but also offers recommendations based on that (truly helpful!)

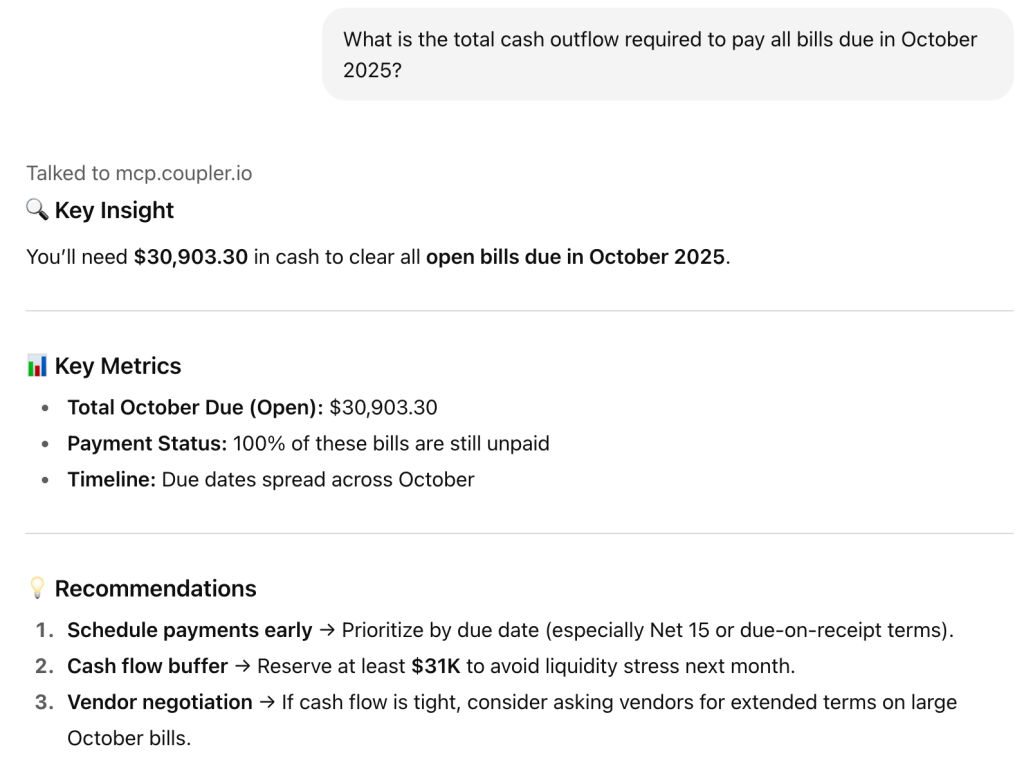

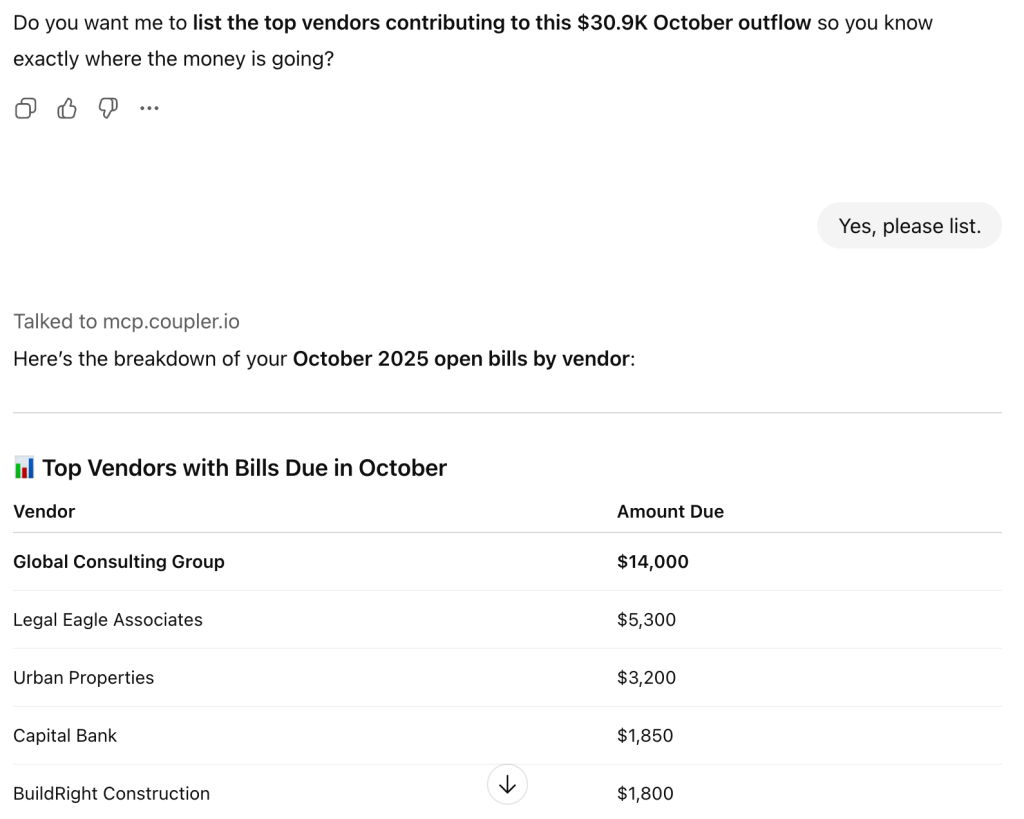

Another good example is asking questions about the predicted cashflow for better financial planning. For example, “What is the total cash outflow required to pay all bills due in October 2025?”

You can take this further through follow-up questions. For example, here I instructed AI to also list the vendors contributing to the cash outflow.

Similarly, play around your data through conversations using the Claude integration by Coupler.io. These tools may also provide you with some basic financial data visualization. However, do not expect too much of this.

In addition to QuickBooks, you can connect 300+ business data sources to your favorite AI tools for data analysis using Coupler.io AI integrations.

Try the QuickBooks dashboard with AI insights for a clear picture

Conversational analytics is a good option to get instant, on-demand answers. However, it’s tedious to ask AI every day about your data. Instead, you can get AI insights right into your reporting dashboard – this is what Coupler.io offers out of the box.

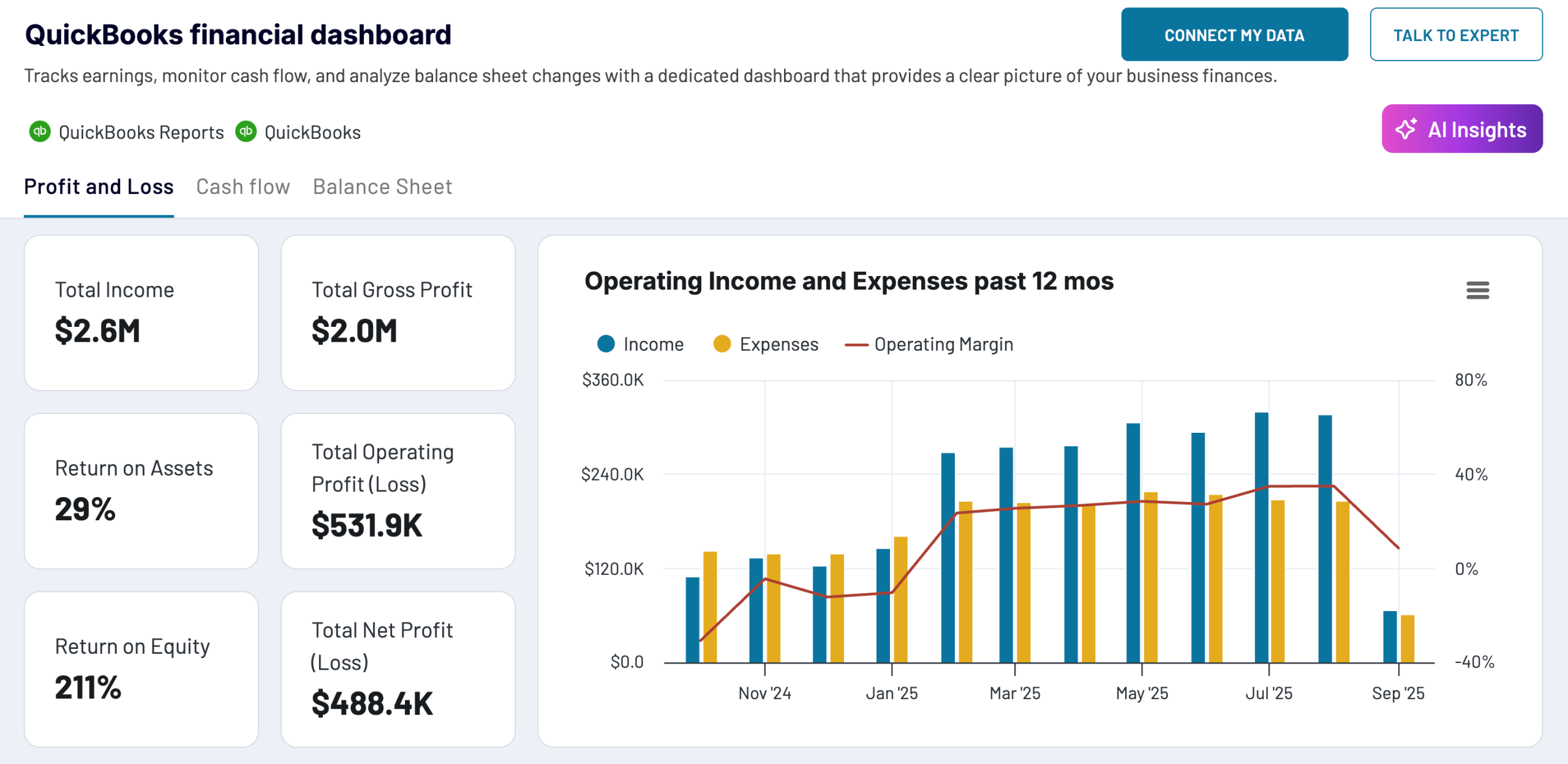

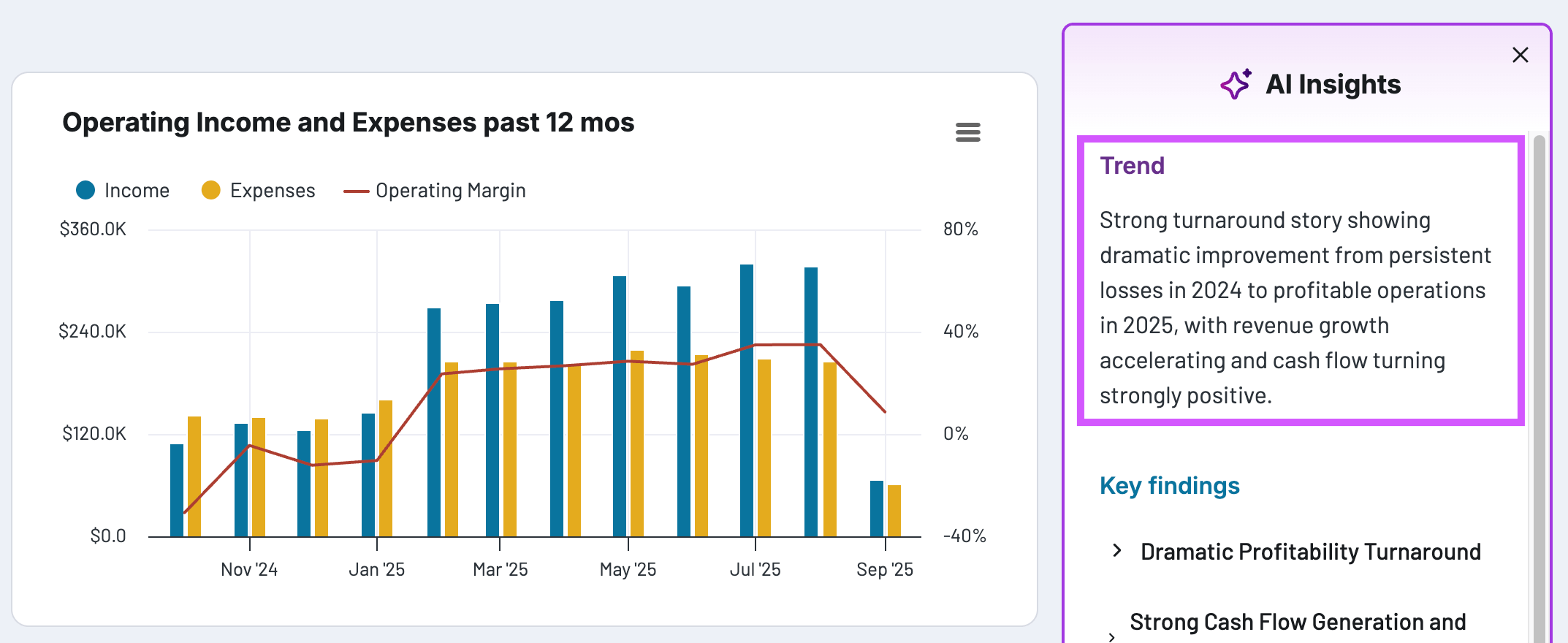

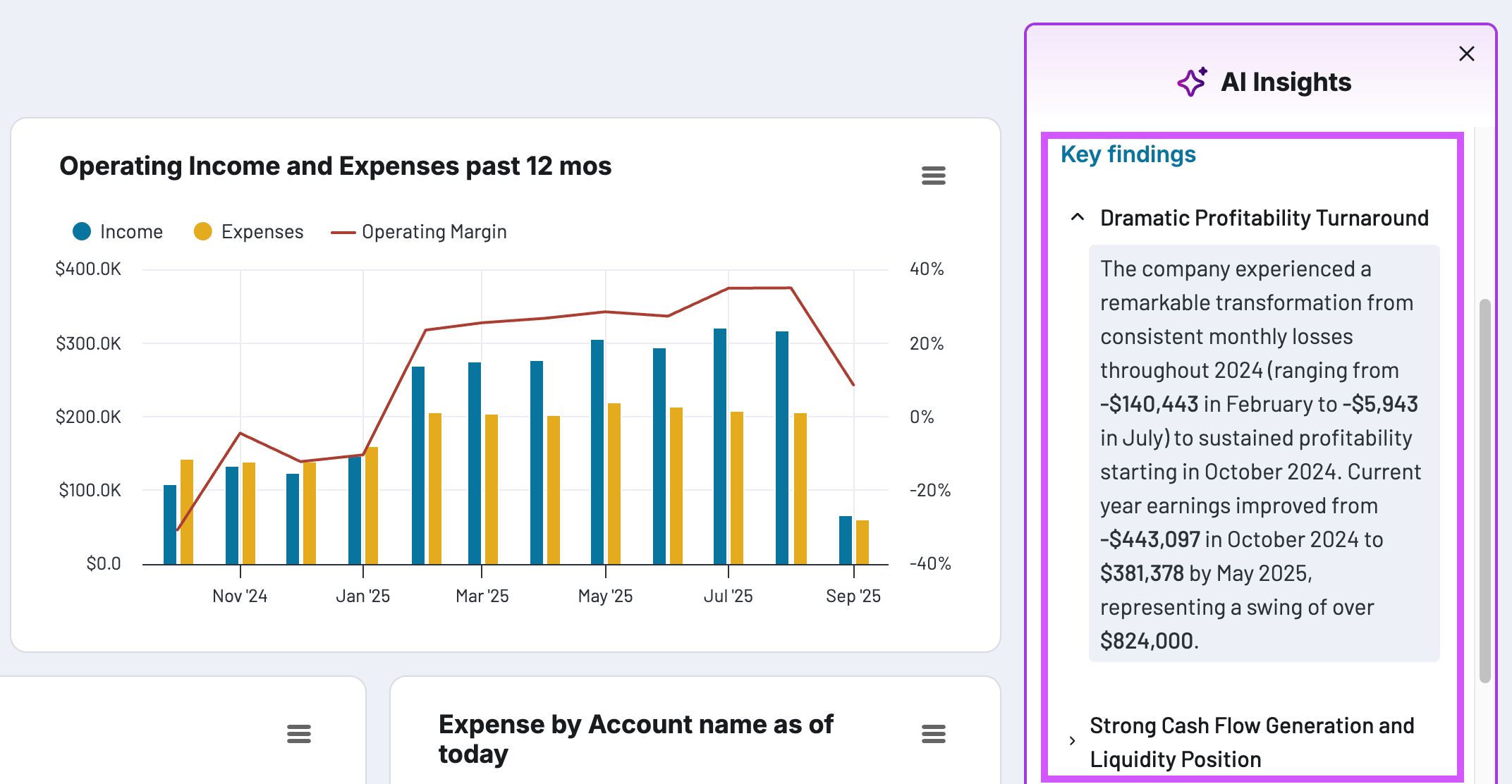

For instance, the QuickBooks financial dashboard provides an overview of financial performance through overviews of Profit and Loss, Balance Sheet, and Cash Flow.

In the top-right corner of the QuickBooks dashboard, you get AI-powered insights – which instantly analyzes your business data and provide a clear summary of the most important trends, key findings, and recommendations.

Trend

You get a high-level brief overview of your “financial story” and where it’s heading. This offers a quick look into your QuickBooks data without needing any manual interpretation. Use these insights to make decisions that maximize your profitability.

QuickBooks financial dashboard

Preview on dashboard

Preview on dashboard

QuickBooks financial dashboard

Preview on dashboardKey findings

The AI Insights also present 5-6 key points that cover different aspects of your QuickBooks data. Click each “finding” to expand them and see related metrics. These points are important to quickly evaluate different aspects of your financial data and make AI-driven decisions.

QuickBooks financial dashboard

Preview on dashboard

Preview on dashboard

QuickBooks financial dashboard

Preview on dashboard

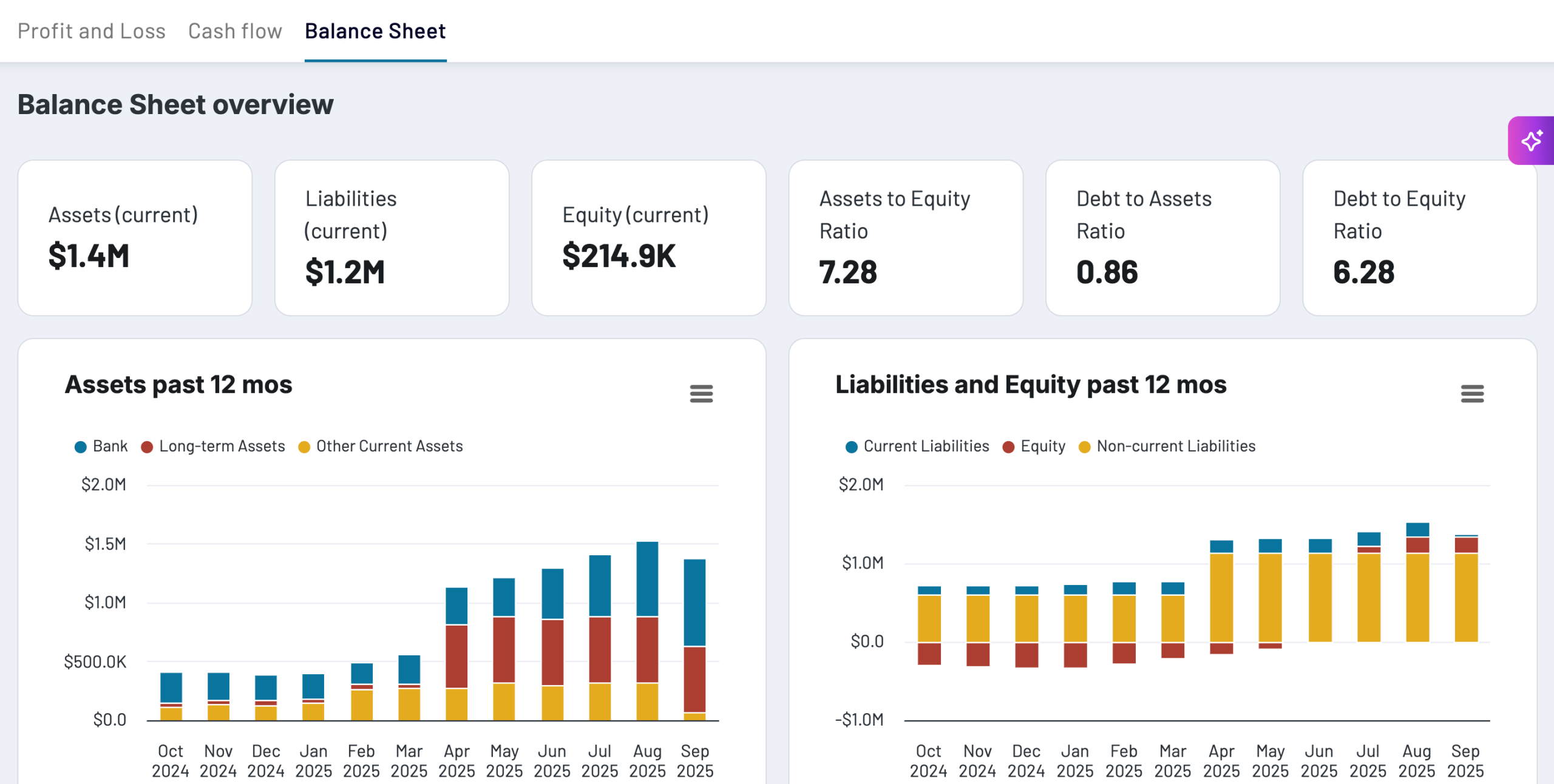

For better clarity, the dashboard is divided into three tabs: P&L, cash flow, and balance sheet.

Track P&L

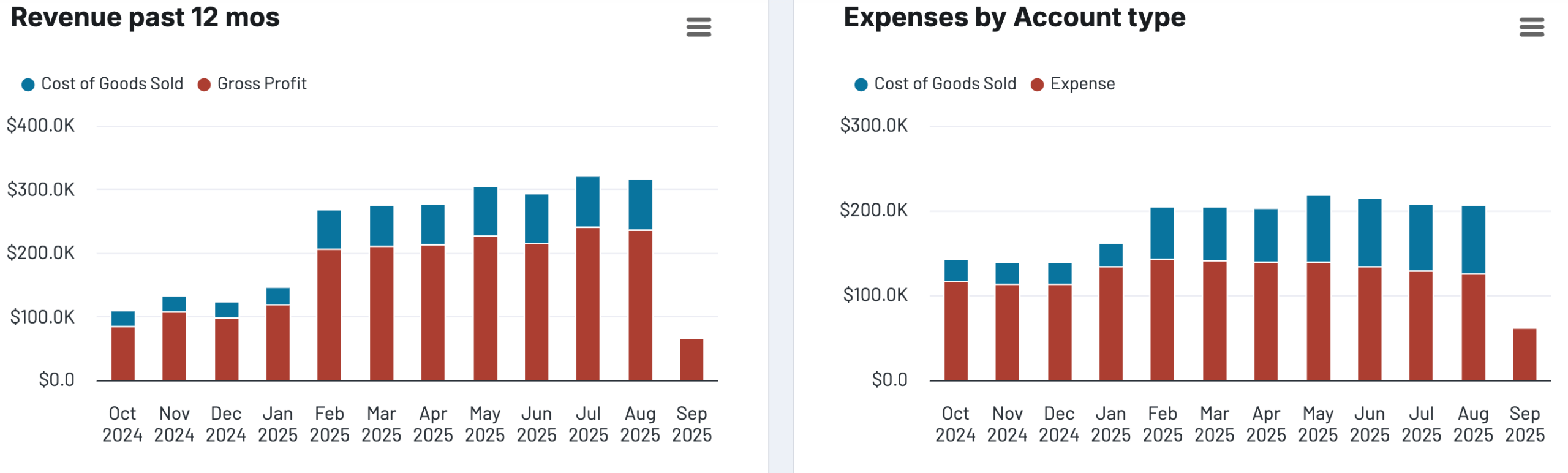

The P&L tab offers a complete overview of your finances. You can also see the 12-month trends for your profits, including their margins through charts.

The breakdown of revenue and expenses by account type helps you monitor and control unwanted spending to stay profitable. In the later part, you can also drill-down the expenses by category for a detailed look.

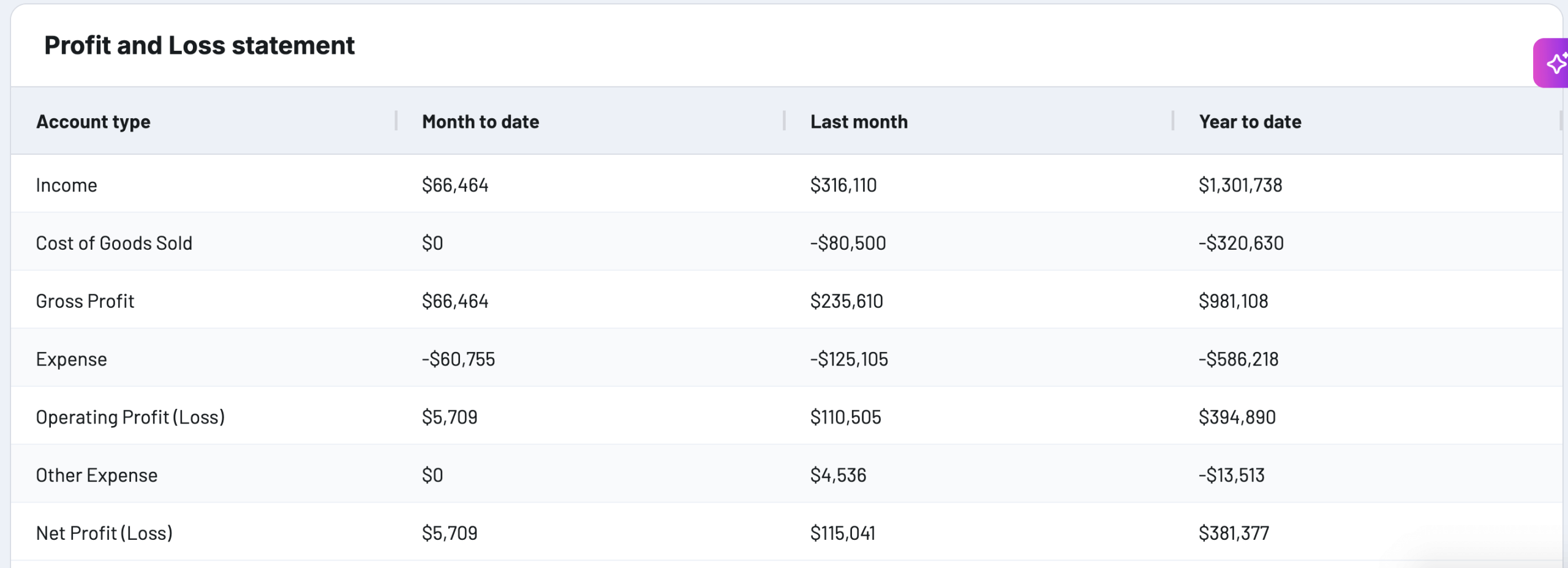

At the bottom of the dashboard, you get a full Profit and Loss statement (with month-to-date, last month, and year-to-date totals).

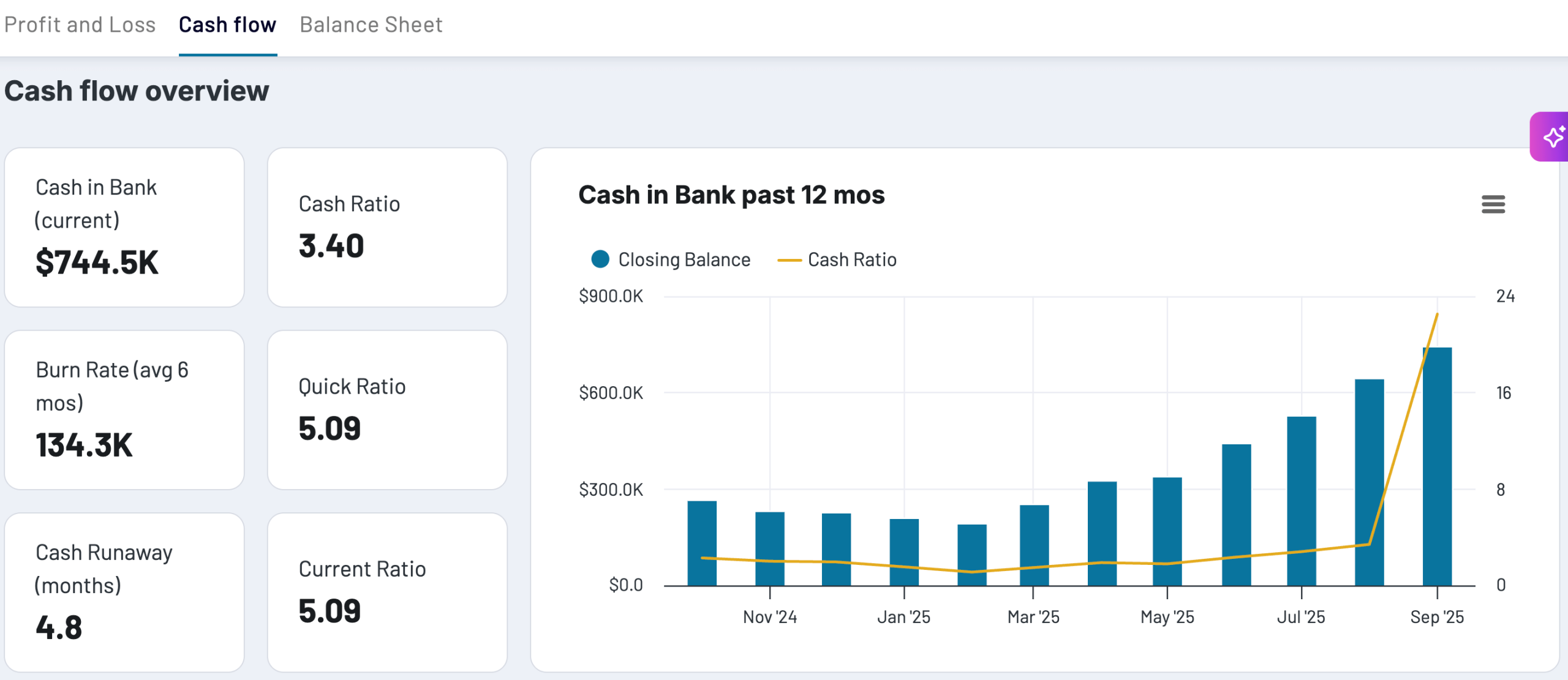

Monitor cashflow

The Cash flow tab offers answers to your hows and wheres related to cashflow. It displays financial KPIs, along with a trend chart to see your cash growth for the last 12 months.

The tab also shows cash by currency, bank accounts, along with a cash statement to help you get a full picture of the cashflow.

Balance sheet

Similarly, the balance sheet offers an overview of the assets and liabilities of the business with charts to analyze the trends.

This financial dashboard offers everything you need to analyze your QuickBooks data and make informed decisions. Further, the dashboard is automated using Coupler.io, meaning you can use it for real-time monitoring and analysis.

To use this financial report template, go to the template and click Connect my data. You’ll need to sign up for a Coupler.io account, which is free and requires no credit card. Once logged in, connect your QuickBooks account to the data flow to start analyzing your data.

Important considerations while using AI to analyze QuickBooks data

While AI offers powerful capabilities for financial data analysis, understanding its limitations and potential risks is crucial for making sound business decisions.

Accuracy and reliability concerns

AI models can occasionally generate inaccurate outputs or “hallucinations”. This will lead to misinterpretation of your financial data. For this reason, critical financial decisions should never rely solely on AI analysis. Best practice involves maintaining human oversight throughout the process—having qualified personnel review AI-generated insights before acting on recommendations.

Data privacy and security

Data privacy represents a significant concern when using AI tools for financial analysis. Some AI platforms may store and process user conversations for training purposes, potentially exposing sensitive business information.

However, most AI tools offer paid plans with enhanced privacy options, including the ability to opt out of using your conversations for model training. This means your financial data discussions can remain private and aren’t used to improve the AI model.

When you use Coupler.io, you maintain full control over what data goes to AI tools. You’re not integrating all QuickBooks data, only the specific datasets you choose to make accessible. Additionally, Coupler.io is SOC2 & GDPR compliant that ensures your financial data remains protected throughout the process.

Contextual and compliance limitations

AI models may lack important business context when analyzing financial data like potentially missing industry-specific nuances, seasonal patterns, or unique circumstances affecting your company. Additionally, AI-generated financial analysis must still comply with accounting standards and audit requirements. Therefore, automated insights don’t replace the need for proper financial governance.

Furthermore, there’s a risk of over-reliance on AI recommendations. While AI can identify patterns and generate insights quickly, financial decisions should always incorporate human judgment, regulatory considerations, and strategic business context that AI may not fully understand.

When implementing AI for QuickBooks analysis, ensure your chosen solution maintains proper audit trails, supports compliance requirements, and integrates seamlessly with your existing financial processes. This way you’ll avoid creating additional complexity in your accounting workflow.

How AI enhances manual data analysis?

While manual data analysis remains essential for business decision-making, AI can address many of its inherent limitations and significantly improve efficiency. Rather than replacing human analysts, AI works best as a powerful complement to human expertise.

| Manual analysis challenges | How AI enhances the process |

| Cognitive bias – Human interpretation influenced by personal experiences, assumptions, and beliefs | Pattern detection – AI identifies data patterns without preconceived notions, though human validation remains important for context |

| Time-intensive processes – Data entry, report building, and interpretation require significant manual effort | Automated processing – AI handles routine data processing and generates preliminary insights, freeing analysts for strategic interpretation |

| Resource intensive – Requires investment in skilled personnel, training, and infrastructure | Efficiency gains – Reduces time spent on repetitive tasks, allowing teams to focus on higher-value analysis and decision-making |

| Limited scalability – Human analysts can only process a finite amount of data within given timeframes | Large-scale analysis – AI can process extensive datasets quickly, identifying trends across multiple data sources simultaneously |

| Reactive analysis – Manual reporting often provides historical insights after events have occurred | Proactive monitoring – AI can continuously monitor data streams and alert analysts to significant changes or anomalies |

The optimal approach

The most effective financial analysis combines AI’s processing power with human expertise. AI excels at handling large datasets, identifying patterns, and providing rapid preliminary insights. However, human analysts remain crucial for interpreting results within business context. This ensures compliance with accounting standards, and enables you to make strategic decisions based on the findings.

This hybrid approach allows businesses to

- Leverage the speed and scale of AI

- Maintain the critical thinking, domain expertise, and contextual understanding that only human professionals can provide.

Which method to choose for getting AI insights from your QuickBooks data

There are quite a lot of tools and ways to analyze QuickBooks data with AI.

But the real problem is picking the one that streamlines the process and gets your team quickly from data to insights. Here is what you need to consider when making a decision:

| Choose QuickBooks native AI if | Choose Coupler.io if |

| • You’re satisfied with automated summaries and basic insights • You only need to analyze QuickBooks data • You want zero setup complexity | • You want full conversational analytics with AI • You need to combine QuickBooks with other business data (marketing, sales, inventory) • You need flexible data export capabilities • You want to choose your preferred AI platform (ChatGPT vs Claude) |

In addition to the above, Coupler.io will also be a smart choice if you need:

- Comprehensive multi-source data analysis

- Advanced data transformation capabilities

- Custom reporting dashboards

- Financial data integration with BI tools

The best part is that you don’t need any technical knowledge or stay dependent on other team members to set it up; thanks to its easy, user-friendly interface.

Further, it also supports integrations for 300+ popular data sources, replacing your entire reporting stack with a single platform.

Integrate data from QuickBooks with AI using Coupler.io

Get started for free